In 1997 the construction sector grew 18.9 percent. The positive result was reflected in the implementation of infrastructure works aimed at homes, shopping malls, offices, hotels, factories. sanitation facilities and sports infrastructure, as well as in the implementation of programs for rehabilitation of roads and rural roads, the program's inception Interoceanic Highway South (Ilo - Desaguadero) and the work of prevention of El Niño in the second half . The commercial construction continued to record an important dynamic, emphasizing the continuation and completion of works Jockey Plaza, Plaza Camacho, Centro Comercial Plaza San Miguel Limatambo and well as the expansion of supermarket chains Wong-Metro and Santa Isabel. Relative to the construction of large hotels, they are concentrated in Lima, highlighting Los Delfines, Royal Park Hotel & Suites and Park Plaza. In addition, we work on the extension and refurbishment of the Sheraton Hotel, Maria Angola and Boulevard. Other construction projects and local improvement related to the expansion of chain restaurants, cinemas, petrol stations and car park. Among the projects for offices, include the continued construction business centers and brown Camino Real Aliaga and the start of construction of the new headquarters of Interbank Banks and Wise. Among the major works by the public sector include the rehabilitation and improvement of water sanitation and sewerage in Lima, Piura, Trujillo, Arequipa, Cusco and the construction of schools by the National Institute of Educational Infrastructure and Health (INFES). Also worth mentioning is the work of preventing the effects of El Niño, performed primarily in the north coast, among these include the construction of accounts and retaining walls, among others. In 1997, record significant progress in the implementation of the Rehabilitation of Transport and the Rehabilitation and Maintenance of Rural Roads. In the first case, asphalted 550 miles, 187 percent more than in 1996. Corresponding 236 to access roads, 157 to the transverse of the Forest and Highway 140 to the Marginal de la Selva. In the second case, 2.2 thousand kilometers rehabilitated. The project started in 1995 and in December 1997 show an advance equivalent to 61por percent of the 7500 kilometers set as a goal. During 1997, the largest physical progress was recorded in the departments of Apurimac, Cajamarca, Ancash, Cusco and Ayacucho. It should be noted that the Corridor Program Interoceanic Road South (Ilo-Desaguadero) is 54 kilometers asphalted. Work began in September and the end of 1997 showed an improvement of 7 percent of total scheduled.

In 1997 the construction sector grew 18.9 percent. The positive result was reflected in the implementation of infrastructure works aimed at homes, shopping malls, offices, hotels, factories. sanitation facilities and sports infrastructure, as well as in the implementation of programs for rehabilitation of roads and rural roads, the program's inception Interoceanic Highway South (Ilo - Desaguadero) and the work of prevention of El Niño in the second half . The commercial construction continued to record an important dynamic, emphasizing the continuation and completion of works Jockey Plaza, Plaza Camacho, Centro Comercial Plaza San Miguel Limatambo and well as the expansion of supermarket chains Wong-Metro and Santa Isabel. Relative to the construction of large hotels, they are concentrated in Lima, highlighting Los Delfines, Royal Park Hotel & Suites and Park Plaza. In addition, we work on the extension and refurbishment of the Sheraton Hotel, Maria Angola and Boulevard. Other construction projects and local improvement related to the expansion of chain restaurants, cinemas, petrol stations and car park. Among the projects for offices, include the continued construction business centers and brown Camino Real Aliaga and the start of construction of the new headquarters of Interbank Banks and Wise. Among the major works by the public sector include the rehabilitation and improvement of water sanitation and sewerage in Lima, Piura, Trujillo, Arequipa, Cusco and the construction of schools by the National Institute of Educational Infrastructure and Health (INFES). Also worth mentioning is the work of preventing the effects of El Niño, performed primarily in the north coast, among these include the construction of accounts and retaining walls, among others. In 1997, record significant progress in the implementation of the Rehabilitation of Transport and the Rehabilitation and Maintenance of Rural Roads. In the first case, asphalted 550 miles, 187 percent more than in 1996. Corresponding 236 to access roads, 157 to the transverse of the Forest and Highway 140 to the Marginal de la Selva. In the second case, 2.2 thousand kilometers rehabilitated. The project started in 1995 and in December 1997 show an advance equivalent to 61por percent of the 7500 kilometers set as a goal. During 1997, the largest physical progress was recorded in the departments of Apurimac, Cajamarca, Ancash, Cusco and Ayacucho. It should be noted that the Corridor Program Interoceanic Road South (Ilo-Desaguadero) is 54 kilometers asphalted. Work began in September and the end of 1997 showed an improvement of 7 percent of total scheduled. Monday, March 28, 2011

Funny Wording For Wedding Invitation Templates

In 1997 the construction sector grew 18.9 percent. The positive result was reflected in the implementation of infrastructure works aimed at homes, shopping malls, offices, hotels, factories. sanitation facilities and sports infrastructure, as well as in the implementation of programs for rehabilitation of roads and rural roads, the program's inception Interoceanic Highway South (Ilo - Desaguadero) and the work of prevention of El Niño in the second half . The commercial construction continued to record an important dynamic, emphasizing the continuation and completion of works Jockey Plaza, Plaza Camacho, Centro Comercial Plaza San Miguel Limatambo and well as the expansion of supermarket chains Wong-Metro and Santa Isabel. Relative to the construction of large hotels, they are concentrated in Lima, highlighting Los Delfines, Royal Park Hotel & Suites and Park Plaza. In addition, we work on the extension and refurbishment of the Sheraton Hotel, Maria Angola and Boulevard. Other construction projects and local improvement related to the expansion of chain restaurants, cinemas, petrol stations and car park. Among the projects for offices, include the continued construction business centers and brown Camino Real Aliaga and the start of construction of the new headquarters of Interbank Banks and Wise. Among the major works by the public sector include the rehabilitation and improvement of water sanitation and sewerage in Lima, Piura, Trujillo, Arequipa, Cusco and the construction of schools by the National Institute of Educational Infrastructure and Health (INFES). Also worth mentioning is the work of preventing the effects of El Niño, performed primarily in the north coast, among these include the construction of accounts and retaining walls, among others. In 1997, record significant progress in the implementation of the Rehabilitation of Transport and the Rehabilitation and Maintenance of Rural Roads. In the first case, asphalted 550 miles, 187 percent more than in 1996. Corresponding 236 to access roads, 157 to the transverse of the Forest and Highway 140 to the Marginal de la Selva. In the second case, 2.2 thousand kilometers rehabilitated. The project started in 1995 and in December 1997 show an advance equivalent to 61por percent of the 7500 kilometers set as a goal. During 1997, the largest physical progress was recorded in the departments of Apurimac, Cajamarca, Ancash, Cusco and Ayacucho. It should be noted that the Corridor Program Interoceanic Road South (Ilo-Desaguadero) is 54 kilometers asphalted. Work began in September and the end of 1997 showed an improvement of 7 percent of total scheduled.

In 1997 the construction sector grew 18.9 percent. The positive result was reflected in the implementation of infrastructure works aimed at homes, shopping malls, offices, hotels, factories. sanitation facilities and sports infrastructure, as well as in the implementation of programs for rehabilitation of roads and rural roads, the program's inception Interoceanic Highway South (Ilo - Desaguadero) and the work of prevention of El Niño in the second half . The commercial construction continued to record an important dynamic, emphasizing the continuation and completion of works Jockey Plaza, Plaza Camacho, Centro Comercial Plaza San Miguel Limatambo and well as the expansion of supermarket chains Wong-Metro and Santa Isabel. Relative to the construction of large hotels, they are concentrated in Lima, highlighting Los Delfines, Royal Park Hotel & Suites and Park Plaza. In addition, we work on the extension and refurbishment of the Sheraton Hotel, Maria Angola and Boulevard. Other construction projects and local improvement related to the expansion of chain restaurants, cinemas, petrol stations and car park. Among the projects for offices, include the continued construction business centers and brown Camino Real Aliaga and the start of construction of the new headquarters of Interbank Banks and Wise. Among the major works by the public sector include the rehabilitation and improvement of water sanitation and sewerage in Lima, Piura, Trujillo, Arequipa, Cusco and the construction of schools by the National Institute of Educational Infrastructure and Health (INFES). Also worth mentioning is the work of preventing the effects of El Niño, performed primarily in the north coast, among these include the construction of accounts and retaining walls, among others. In 1997, record significant progress in the implementation of the Rehabilitation of Transport and the Rehabilitation and Maintenance of Rural Roads. In the first case, asphalted 550 miles, 187 percent more than in 1996. Corresponding 236 to access roads, 157 to the transverse of the Forest and Highway 140 to the Marginal de la Selva. In the second case, 2.2 thousand kilometers rehabilitated. The project started in 1995 and in December 1997 show an advance equivalent to 61por percent of the 7500 kilometers set as a goal. During 1997, the largest physical progress was recorded in the departments of Apurimac, Cajamarca, Ancash, Cusco and Ayacucho. It should be noted that the Corridor Program Interoceanic Road South (Ilo-Desaguadero) is 54 kilometers asphalted. Work began in September and the end of 1997 showed an improvement of 7 percent of total scheduled. Panty Girdle With Suspenders

The sector registered a decline of 4.6 percent, mainly due to lower activity of Rehabilitation and Maintenance of Roads and reducing the rate of implementation of various educational infrastructure and irrigation by the public sector. In the Rehabilitation and Maintenance of Roads 200 km asphalted, down from 86 percent to asphalt in 1995 (1.4 thousand kilometers). Of which 27 kilometers are the Panamerican Highway North, 88 Central Road, 6 to the access roads and 79 to cross the forest. This was achieved a 82 percent advance in installments bid and 77 percent of schedule. In 1996 we continued the Rehabilitation and Maintenance of Rural Roads, which began as a pilot plan in July 1995, 1.8 rehabilitated thousands of miles of rural roads, secondary roads 432 and 29 I

Jenna Jameson Mechanic

construction sector's GDP grew 17.5 percent, reflecting the one hand, the implementation of infrastructure projects, residential and, secondly, the continuation of the Rehabilitation and Maintenance roads administered by the Ministry of Transport, Communications, Housing and Construction as well as conducting educational infrastructure and irrigation by the public sector, which was Executing Unit Development Institute (INADE). Among the infrastructure projects of the private sector include those related the hotel sector, aimed to address the recovery of tourism, which meant an extension of 6 744 rooms considering hotels, hostels and 1 578, taking into account only hotels. Among the main buildings include La Colina del Golf, House San Isidro Club, Los Andenes de Monterrico. Park and Royal House Suites Hotels in San Isidro, El Pilar and Palace Apart. in Lima, the Monastery and the Holiday Inn in Cusco and the Grand Marquis in Trujillo. Also. expanded hotels and El Pardo El Olivar in Lima, Ica Mossone and El Libertador, Arequipa and Cusco. In addition, several projects came running. such as Oro Verde Hotel. Dolphins. Apart Plaza Park in the capital and the Holiday Inn in Arequipa. For its part, the public housing projects developed by the National Company for Construction and Building (ENAC) with the construction of housing in various parts of the country, while the National Institute of Educational Infrastructure and Health Services (INFES) continued with the construction of schools. With regard to projects managed by Inada, work continued on the Jequetepeque-Zana (Talambo Canal construction) and the second stage of the Chavimochic, while work was carried out repair and maintenance in the reservoir Poechos. The Rehabilitation and Maintenance Program Road included a total of 1 35 1 km, of which 1 034 were for the North American. 100 to the American South and Highway 217 to Central. With it. it reached a 94 percent advance in the bid and reaches 78 percent of scheduled. On the other hand, started the Pilot Project for Rural Roads Rehabilitation and Improvement of Streets. with the reconstruction of 1 524 km deprimiday economy more difficult to access, located in Ancash. Apurimac, Ayacucho. Cajamarca, Cusco and Huancavelica.

construction sector's GDP grew 17.5 percent, reflecting the one hand, the implementation of infrastructure projects, residential and, secondly, the continuation of the Rehabilitation and Maintenance roads administered by the Ministry of Transport, Communications, Housing and Construction as well as conducting educational infrastructure and irrigation by the public sector, which was Executing Unit Development Institute (INADE). Among the infrastructure projects of the private sector include those related the hotel sector, aimed to address the recovery of tourism, which meant an extension of 6 744 rooms considering hotels, hostels and 1 578, taking into account only hotels. Among the main buildings include La Colina del Golf, House San Isidro Club, Los Andenes de Monterrico. Park and Royal House Suites Hotels in San Isidro, El Pilar and Palace Apart. in Lima, the Monastery and the Holiday Inn in Cusco and the Grand Marquis in Trujillo. Also. expanded hotels and El Pardo El Olivar in Lima, Ica Mossone and El Libertador, Arequipa and Cusco. In addition, several projects came running. such as Oro Verde Hotel. Dolphins. Apart Plaza Park in the capital and the Holiday Inn in Arequipa. For its part, the public housing projects developed by the National Company for Construction and Building (ENAC) with the construction of housing in various parts of the country, while the National Institute of Educational Infrastructure and Health Services (INFES) continued with the construction of schools. With regard to projects managed by Inada, work continued on the Jequetepeque-Zana (Talambo Canal construction) and the second stage of the Chavimochic, while work was carried out repair and maintenance in the reservoir Poechos. The Rehabilitation and Maintenance Program Road included a total of 1 35 1 km, of which 1 034 were for the North American. 100 to the American South and Highway 217 to Central. With it. it reached a 94 percent advance in the bid and reaches 78 percent of scheduled. On the other hand, started the Pilot Project for Rural Roads Rehabilitation and Improvement of Streets. with the reconstruction of 1 524 km deprimiday economy more difficult to access, located in Ancash. Apurimac, Ayacucho. Cajamarca, Cusco and Huancavelica. Prepaid Card For Bangbros

Movies Of Men Being Raped By Men

Sunday, March 27, 2011

Girdle Holds Tummy In

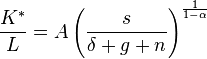

equality, we can replace the capital, thus obtaining the steady-state capital.

equality, we can replace the capital, thus obtaining the steady-state capital.

.

Furthermore, using we get: Template: Equation In steady state, it is possible to determine the following conclusions:

* Increases the level of technology produce more output per capita steady. Also, greater labor force have a positive impact on the stationary product. Conversely, increases in the rate of population growth, and higher depreciation, would result in low per capita effective stationary products.

* At steady state, since

, the growth rate of total output is equal to n + g and the rate of growth of output per capita is equal to g. The per capita product would grow only steady state growth rate of technology.

, the growth rate of total output is equal to n + g and the rate of growth of output per capita is equal to g. The per capita product would grow only steady state growth rate of technology. London Cruising Places

An increase in the saving rate would increase, thereby increasing the steady-state capital. The effect of the savings rate has an effect of faster growth in the short term, but in the long term the effect is nil. Basically, the savings rate has an effect on the product level, not the effects of the rate of rise of technology, which are effects of long-term growth.

An increase in the saving rate would increase, thereby increasing the steady-state capital. The effect of the savings rate has an effect of faster growth in the short term, but in the long term the effect is nil. Basically, the savings rate has an effect on the product level, not the effects of the rate of rise of technology, which are effects of long-term growth. How Do You Turn Yourself Into A Wolf

As it is assumed that the previous system will feature a unique solution and the per capita income levels effective, capital per capita cash, savings rate, rate of technological change and the same depreciation rate determine the called state of equilibrium or steady state of the Solow model.

This is the main chart of the Solow model and shows that in the long run equilibrium. The reason for convergence is that and is equal to the function of per capita GDP has diminishing returns, so the investment function effectively. Thus, diminishing returns to capital per capita mean that there is a convergence between replacement investment and actual investment. In the graph, k "EST" represents the steady state capital and, therefore, the state stationary product.

Subjects In Secondary School Singapore 1970

Where:

= Savings rate

= Savings rate  = Product of the economy in period t

= Product of the economy in period t  = rate of depreciation of existing capital.

= rate of depreciation of existing capital.  = Total capital in period t

= Total capital in period t  The term represents the actual investment in capital that can perform

The term represents the actual investment in capital that can perform economy, which is the product multiplied by the rate of savings (since the model assumes that all savings are inverted). The second term of the equation represents the investment

replacement (or depreciation costs) that represents how much capital is no longer useful or useless for the accumulation of capital. To further explore the replacement investment is necessary to determine the same equation in per capita terms and effective.

replacement (or depreciation costs) that represents how much capital is no longer useful or useless for the accumulation of capital. To further explore the replacement investment is necessary to determine the same equation in per capita terms and effective. To calculate the increase in capital stock per capita, deriving, using the chain rule and the resulting equation substiyendo the result (4) we have:

Where:

This last equation has the look like (4), but in per capita terms, with an investment of replacement equal to that

shows the amount of investment capital needed to maintain constant. Increases in depreciation, would decrease the effects of capital accumulation, and therefore, a lower [steady state] of capital. Increases in the rate of population growth, would cause a smaller increase or decrease in capital accumulation per capita cash.

investment is necessary for effective movement can sustain itself or depreciation, as well as population growth and new technology needed to produce physical investment. If we have high rates of population growth, is difficult for the per capita cash capital increase, as there will be more machines to distribute among new potentially productive individuals who enter the market. Also, increases in the rate of technology need to produce new machinery, so there must be investment to support effective technology increases.

investment is necessary for effective movement can sustain itself or depreciation, as well as population growth and new technology needed to produce physical investment. If we have high rates of population growth, is difficult for the per capita cash capital increase, as there will be more machines to distribute among new potentially productive individuals who enter the market. Also, increases in the rate of technology need to produce new machinery, so there must be investment to support effective technology increases. Do Aka's Have Probates

The model seeks to find the relevant variables that cause a country's economic growth (closed economy), as some help to improve the situation only in the short term and others that affect growth rates long term. All variables are taken that the model considers as significant in the growth process as exogenous, but shows the incidence of these in the growth process. The model uses the Cobb-Douglas:

The model seeks to find the relevant variables that cause a country's economic growth (closed economy), as some help to improve the situation only in the short term and others that affect growth rates long term. All variables are taken that the model considers as significant in the growth process as exogenous, but shows the incidence of these in the growth process. The model uses the Cobb-Douglas:

Defining variables, we have:

K = total capital

L = total labor force or labor used in production.

A = is a mathematical constant which depends on the level of technology.

And = Total [measured in monetary units, for example].

α = fraction of product from the capital or the income coefficient Diminishing marginal.

the hypothesis that the production function is Cobb-Douglas function is not essential to the model, it would suffice to be a monotone increasing function of capital and the amount of work.

To formulate the model from the Cobb-Douglas function is defined for convenience:

• Product per capita cash and the amount of output per unit of labor and

• The capital stock per capita cash k as the amount of capital per unit labor

words, define the variables:

As we have assumed that the production function is Cobb-Douglas has the following relationship between yyk:

Assuming actual output per capita and the above function, we have that the smaller α will be a product per capita cash dwindling, ie the function takes the form of a root, although the function is divergent to infinity when k tends to infinity. The above function satsiface Inada conditions, namely:

What Happened Denise Milani Official

growth model of Robert Solow (1956), known as exogenous growth model and the neoclassical growth model is a macroeconomic model designed to explain economic growth and the variables that affect in the long term. Intuitive Explanation

growth model of Robert Solow (1956), known as exogenous growth model and the neoclassical growth model is a macroeconomic model designed to explain economic growth and the variables that affect in the long term. Intuitive Explanation Solow model intended to explain how increasing domestic production of goods and services through a quantitative model. In the model basically involves domestic production (Y), the savings rate (s) and the provision of fixed capital (K). The model assumes that the gross domestic product (GDP) is equal to national income (ie assume a "closed economy" and therefore there are no imports or exports).

production on the other hand depend on the amount of labor employed (L) and the amount of fixed capital (machinery, facilities, etc) used in production (K) and available technology (if the technology improved the same amount of labor and capital could occur again, although the model is usually assumed that the level of technology remains constant.) The model assumes that the way to increase GDP by improving the allocation of capital (K). Ie what is produced in a year a part is saved and invested in accumulating more capital goods or fixed capital (plant, machinery), so that next year may produce a slightly larger amount of property, as there will be more machinery available for production.

In this model economic growth is mainly due to the accumulation constant capital, where each year more machinery and facilities available (fixed capital) to produce progressively higher yields are obtained, whose long-term cumulative effect will have a notable increase in production and, therefore, a remarkable economic growth.

Among the qualitative predictions of the growth model is based purely on capital accumulation, without altering the amount of labor or alter the saving rate is progressively smaller, reaching a steady state in which there is no more growth and investment exactly offsets the depreciation associated with the wear of fixed capital.

Tuesday, March 22, 2011

The Price Is Right Bag Bus

"The last three quarters of last year not only had record numbers of job creation, but also the economy grew about 6%," he told reporters the head of Chile's public finances, Felipe Larraín, commenting on the figures from the Central Bank.

"The last three quarters of last year not only had record numbers of job creation, but also the economy grew about 6%," he told reporters the head of Chile's public finances, Felipe Larraín, commenting on the figures from the Central Bank. Chilean Finance Minister, Felipe Larraín, said the 5.2 percent growth achieved by the Chilean economy in 2010, "reflects a total recovery from the effects of the earthquake" on 27 February of that year.

"The last three quarters of last year not only had record numbers job creation, but also the economy grew about 6%, "he told reporters the head of Chile's public finance, in commenting on the figures provided by the Central Bank.

The sender said the gross domestic product ( GDP) grew in 2010 by 5.2 percent, with increases of 1.7% in the first quarter, from 6.4% in the second, from 6.9% in the third and 5.8% in the fourth quarter.

The 8.8 magnitude earthquake on 27 February, which was followed by a tsunami left more than half a thousand dead, 800,000 homeless and damages estimated at 30,000 million dollars.

Larraín stressed that the expansion of activity was "a significant increase in consumption, with annual figures of over 10%, and investment, which grew about 19%. "

also stressed job creation, which reached 400,000 jobs last year.

domestic demand, according to the Central Bank grew by 16.4% and investment in gross fixed capital formation by 18.8% did.

Larraín also supported the decision taken Thursday by the Central Bank to raise the monetary policy rate by 50 basis points to 4.0% per year, and said, "we must consider where we came from: from a very low rate of 0.5% (July 2010), which occurred amid the economic crisis.

"We are in a process of normalization that has no great surprise, since we must avoid the great scourge of inflation," he said.

Meanwhile, Economy Minister Juan Andrés Fontaine also welcomed the GDP growth reached Chile in 2010 and was optimistic about a breakthrough "of more than 6 percent" this year.

"We are on track to record a growth of six percent or slightly higher this year "he said.

What Kind Of Extensions Does Lauren London Wear

Carlos Osorio, Minister of People's Power for Food said Tuesday it is developing a plan called "biennial 2011-2012" will ensure access to food "first quality and excellent conditions for the Venezuelan people."

"As for that we currently approximately 49% storage capacity in all our national silos," said the Minister during his participation in the "awakened Venezuela" that transmits (VTV).

said that the biennial plan for the period 2011-2012 to implement the National Government at this stage agroproductive plans to increase by 300,000 tons per month until the total food production in the country.

He noted that increasing food production at 300,000 tonnes, will strengthen food sovereignty.

other hand, Osorio said that price adjustments will be made in wheat flour, bread and pasta faucet because "their products are necessarily imported raw materials."

"We are accustomed for many years to be a highly consumer of wheat," he argued.

In this regard, Osorio reiterated "that in order to protect the people, the revolutionary government knows it must make some adjustments."

also explained that the bread tap, which was covered in 4.45 VEB will be sold from today to 5.52 Bs and pasta that was Bs 3.26 per kilo increases to 4.33.

Ovidrel False Positive

Uruguay's economy grew 8.5% in 2010, said Monday the Central Bank of Uruguay.

Rare Candy Cheat For Pokemon Ruby Rom

The general government debt stood at the end of 2010 at 638.767 million euros, representing an increase of 77.448 million compared to the end of 2009, when there were 561.319 million under this heading. Is an increase of 13.8%. By type of administration, the debt rose to 48.924 million euros in the plant, 11.1% to 487,870 million.

The general government debt stood at the end of 2010 at 638.767 million euros, representing an increase of 77.448 million compared to the end of 2009, when there were 561.319 million under this heading. Is an increase of 13.8%. By type of administration, the debt rose to 48.924 million euros in the plant, 11.1% to 487,870 million. In the regions recorded the largest increase. Their debt grew by 31.7% (27,790 million), and you should 115.455 million euros.

contrast, in municipalities remained well contained. Rose just 2.1%, to 35.442 million, which are more than 734 million in late 2009.

With these figures, the ratio of debt to GDP exceeds the English economy for the first time since 1999 the benchmark of 60%. In particular comes to 60.1% compared to 53.3% at end-2009.

The Central Administration has risen from 41.6% to 45.9% in the regions from 8.3% to 10.9%, and the municipalities has remained at 3.3%.

debt of the regions increased by 31.7% in 2010 and 10.9% of GDP

For

communities

The data show that since 1995, borrowing by the regions has not stopped grow, breaking record highs each year, despite the commitment to budgetary stability acquired in recent years.

autonomous community with the largest debt in 2010 was again Catalonia, with 31.886 million euros, an amount that represents 27.6% of the total debt accumulated in the whole community.

After Catalonia, Valencia stood (17,600 million euros) returning to second place ahead of Madrid, whose debt rose to 13.492 million euros. Among the three, accumulate 54.5% of total regional debt.

Below are Andalucía (12.176 million euros), Galicia (6.162 million), Castilla-La Mancha (5.819 million), Basque country (4.916 million), Castilla y León (4.294 million euros), Baleares (4.064 million ), Canary Islands (3.298 million), Aragon (2,901,000) and Murcia (2,107 million). Completing the list

Extremadura (1,747 million), Navarra (1,725 \u200b\u200bmillion), Asturias (1,634 million), La Rioja (726 million) and Cantabria (911 million).

Pool Table Blueprint Free

President of the Republic, Hugo Chávez, on Tuesday urged the president of Banco de Venezuela, Humberto Ortega Díaz, to relax the requirements stipulated by the bank for lending to finance plans community.

President of the Republic, Hugo Chávez, on Tuesday urged the president of Banco de Venezuela, Humberto Ortega Díaz, to relax the requirements stipulated by the bank for lending to finance plans community. "The Bank of Venezuela must be for socialism, can not be governed by the patterns of capitalism that we've talked a hundred times and you know it," Chavez said by telephone Ortega Díaz national radio and television

A representative of the community of La Vega told the president that people are TBcom leaving the Bank of Venezuela to try another bank.

"I would ask that the Bank of Venezuela that will help us communicate because there are many people who need their credits, but the Bank of Venezuela is putting us and very hard, then that is a little more flexible with credit because the requirements are too many, "asked Rosa Carrillo before television cameras on national television.

Banco de Venezuela was incorporated earlier this year to the Community Banking Terminal System (TBcom) created by the government to bring communities all banking services.

"I ask for a report for this evening to talk this topic, I want you to call Rose and everyone in it if we open TBcom TBcom to continue using the same methodology of a Bank that serves the poor, then what are we going to open. That would be worth the saying that says' you got me and I danced, "Chavez told Ortega Díaz.

"People are complaining that many requirements asked if people complain is that some have tried to acquire credits TBcom" said the president.

Monday, March 21, 2011

Charriol Bracelets In Cebu

Eurozone ministers yesterday reached agreement on the contributions of each member state permanent future bailout fund, which will force since 2013 and to which Spain will contribute 11.9%. This fund will have a capacity of 500,000 million financing to help countries with solvency problems, but this will require a total capital of 700,000 million, explained the President of the Eurogroup, Jean Claude Juncker.

Eurozone ministers yesterday reached agreement on the contributions of each member state permanent future bailout fund, which will force since 2013 and to which Spain will contribute 11.9%. This fund will have a capacity of 500,000 million financing to help countries with solvency problems, but this will require a total capital of 700,000 million, explained the President of the Eurogroup, Jean Claude Juncker. Of this amount, 80,000 million will be contributed as capital paid (half of them in 2013 and the other in the next three years) to 620,000 million will be mobilized in the form of capital and guarantees. According to these figures, Spain will contribute 9.523 million in capital invested, half of them in 2013 and 73.804 million as other capital mobilized and guarantees, to add 83.328 million euros. At the end of the meeting, Finance Minister, Elena Salgado welcomed the fact that the English contribution will not count as debt.

rescue fund in the Eurozone was created in May last year as a temporary measure to prevent the spread of the Greek crisis to other countries, with an initial budget of 440,000 million which, together with the contribution of the European Commission International Monetary Fund (IMF), total 750,000 million.

However, the EU decided to make permanent this temporary measure to prevent future crises and to provide the future fund with 500,000 million financing capacity. Juncker said that the future permanent fund will be based in Luxembourg and will be governed by a board of governors composed of the finance ministers of the Eurozone, advised by the Commissioner for Economic and Monetary Affairs and the European Central Bank president. The bailout fund future sovereign debt can buy but only in the primary market and not in the secondary market, contrary to the intention of the ECB.

finance ministers of the Eurozone left for later the rescue fund reform in force. Salgado bid to increase the capacity of the current fund by increasing the guarantees, but Germany requested capital injections part less creditworthy countries, including Spain. The English contribution to the current bailout fund also rises to 11.9%, equivalent to 52.352 million in guarantees.

Meanwhile, Spain is improving its relationship with the markets. The risk premium fell below 200 basis points and Russia authorized the National Welfare Fund to invest some of its 95,000 million euros in English debt, and amending its decision of November 2010, when it excluded to Spain the list of countries whose debt may be gained.

S/n Adobeafter Effect Cs3